CANNABIS PAYMENT PROCESSING

Solutions for your Cannabis & CBD Business.

A huge step forward for Cannabis payment processing.

No miscoding: actual DBA is on the descriptor

No convenience fees

No contracts!

As featured in:

How does  Processing Work?

Processing Work?

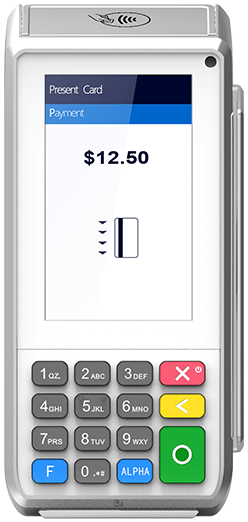

Our truly transparent merchant processing program is the first traditional, compliant, and legitimate card payment solution.No workarounds, no smoke and mirrors – just simple, frictionless, and secure payments to promote the sustainability of the industry.

Transactions are for exact dollar amounts (as opposed to cashless ATMs) ,which means no cash handling, costly mistakes, no customer confusion at checkout, and no need for drivers to carry any money.

Now you can accept payments like the rest of the world so you can focus on what you do best: growing your business.

Program highlights include:

Fully endorsed and approved by the major debit networks

Costs less than cash handling and transportation fees

Full bank and processor disclosure

No miscoding: actual DBA on the descriptor

No “Out of Network” fees

No convenience fees

No contracts

No early termination fees

No annual fees

No application fee

-cropped.png)

Merchant Processing vs. Cashless ATMs

We will get you approved when others cannot.

Cashless ATM, is a workaround that many dispensaries have utilized. Unlike a typical card-based transaction, cashless ATMs appear to the bank as an ATM transaction, but in reality, the dispensary treats the transaction as a regular debit card swipe.

Customers “withdraw” cash at the counter to cover their purchase (minus the ATM fee), and the cashier gives them the leftover cash as change.

These transactions rely on deception, and oftentimes, these workarounds are quickly shut down once discovered by the bank.

CreditCardProcessor.com fully compliant and transparent merchant processing system makes cashless ATMs obsolete.

CreditCardProcessor.com Merchant Processing

- Sales are for the precise dollar amount of the purchase

- Customer does not pay a convenience fee

- 100% transparent – full acquiring bank disclosure

- No cash handling

- Frictionless checkout process

- Sales increase 25%+ versus cashless ATMs or cash

- Seamless transition to credit cards when federal change allows

- No contract

- No early termination fees

- True DBA and business address on descriptor and receipts

- Fully transparent bank approved cannabis program

Cashless ATM

- Sales must be rounded up to the nearest $5 to $20

- Customer pays convenience fee and typically an out of network fee

- Acquiring bank not disclosed in most cases

- Dispensary associate must provide change

- Checkout requires explanation

- Sales, on average, increase 18% versus cash

- Requires new merchant account for credit cards when federal change allows

- 3 to 5 year contracts

- High early termination fees

- Disguised DBA and false address information is common

- Bank not aware of cannabis transactions or ATM placements

Cannabis Merchant processing program pricing:

Cannabis Merchant processing program pricing:

The fees for the CreditCardProcessor.com Cannabis merchant processing program are as follows:

- Interchange, plus 3.99% and $.35/transaction

- $30/month – includes account statement, PCI, and online reporting

How to Reach Us

10300 W. Charleston Blvd., Suite 13-127 Las Vegas, NV 89135